Axelar - 2. Squid Launch Analysis

Mthodology and project overview

Axelar’s first ecosystem project, Squid, launched last week as a cross-chain liquidity router.

==Task==

Using the relevant contracts found here, analyze Squid’s first week of activity. Provide analysis on the following metrics:

Total Unique Users Average USDC transfer amount Most popular source/destination chains Most popular pathways Total Unique Tokens swapped Total Volume transferred

Method

This dashboard consists of 6 main sections. In the first 5 parts, Ethereum, Binance, Arbitrum, Avalanche and Polygon blockchains have been examined and analyzed in terms of volume and number of swaps, number of users, from a general perspective, tokens and routes. In the final part, all these blockchains and paths are compared in terms of the mentioned criteria.

What is the Squid Protocol & how does it enable cross-chain liquidity?

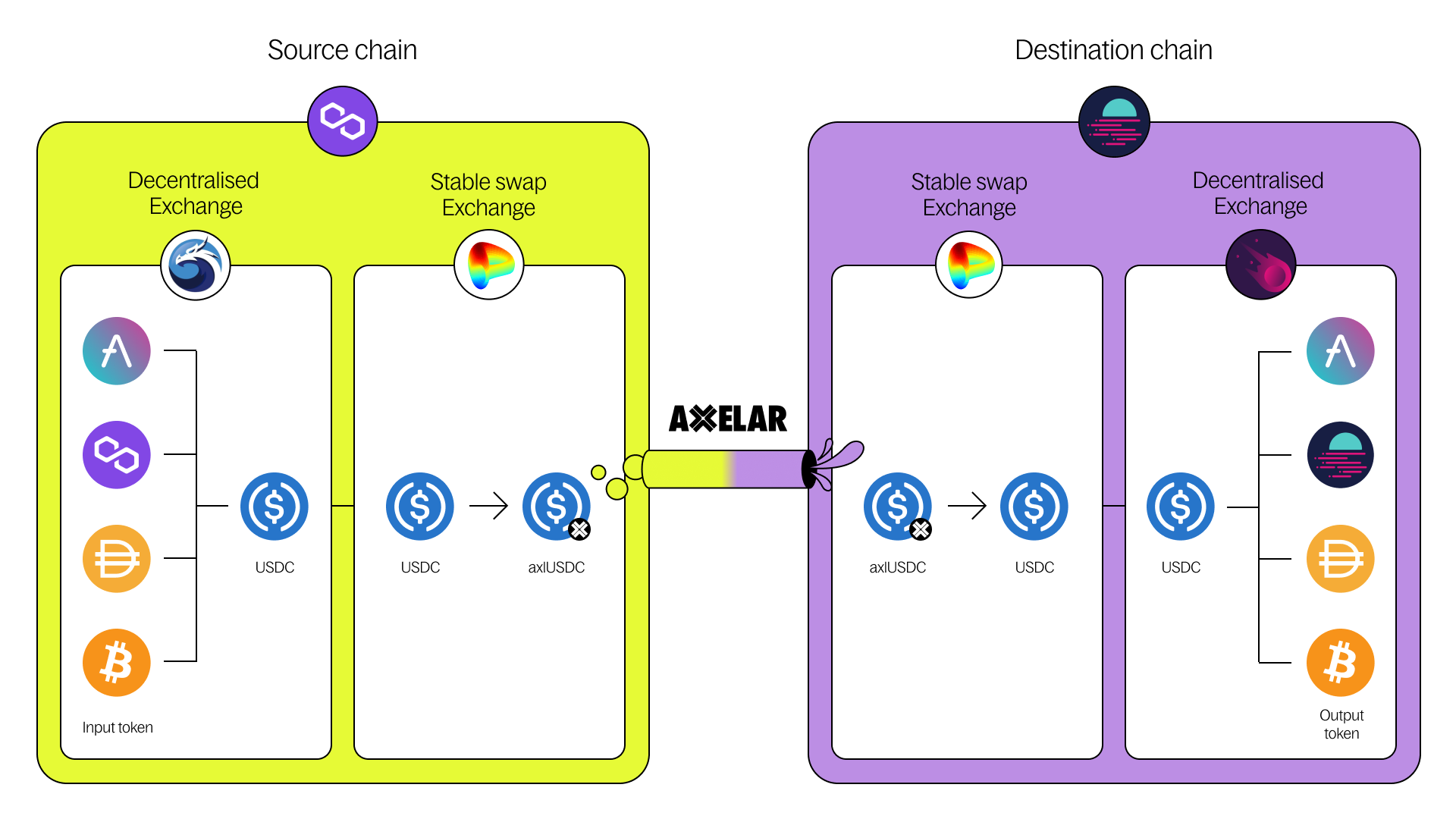

Squid is delivering the cross-chain future for both developers and users. For developers, Squid is a protocol that enables cross-chain liquidity routing and swaps through a single Javascript software development kit (SDK). This routing allows for the swapping of any tokens across all the supported chains, by connecting users to liquidity pools on dexes anywhere in Web3. The SDK works by getting a route that returns the details of the token transfer and the cost to execute it. Developers can then execute the transfer with the required signer and route.

Squid uses Axelar's General Message Passing capabilities to enable smart contract calls across multiple chains. Using the multicall feature of Squid, applications can call multiple contracts in sequence. Use cases might include swapping tokens using a dex on another chain, then using the acquired tokens in another dApp. This feature delivers cross-chain liquidity, and saves time for both users and developers as a signature for the second transaction is not required.

What this means for users is one-click transactions. They will not need to download multiple wallets to sign the transactions across different chains. Users can buy NFTs from any marketplace, play a game on another chain or transact with multi-chain DeFi protocols, without any extra steps. Squid enables dApps to source cross-chain liquidity and deliver this kind of experience, using security provided by the Axelar network.

What is the Axelar network?

Axelar network is a decentralized state machine responsible for facilitating cross-chain requests. The network supports a few key protocols, such as Cross-Chain Gateway Protocol (CGP). CGP is at the heart of the system and allows us to easily onboard new chains with no constraints on the consensus rules and transfer information across them. In this post, we’ll take a look at what makes CGP tick and dive inside some details behind the stack. But first, let’s try to understand what led us to this architecture. 1

Observations

According to the obtained results:

-

The total amount swapped from this network using the Squid platform was $227k, which was done by 73 people in 151 transactions. The average amount is 1144 dollars.

-

February 12 was the peak amount of transactions with 67 thousand dollars in total of 15 transactions.

-

83.9% of swaps belonged to wETH. USDT is next with 11%. Also, 78% of users have chosen wETH for this purpose.

-

Ethereum to Fantom has been the most popular path among users of this platform in Ethereum with more than 54% of the amount of tranches. Ethereum to Moonbeam is in the next position from this point of view.

\

Observations

According to the obtained results:

- The total amount swapped from this network using the Squid platform was $826k, which was done by 294 people in 774 transactions. The average amount is 389 dollars.

- February 9 was the peak amount of transactions with 126 k $ in total of 56 transactions.

- 80% of swaps belonged to wMATIC. USDT is next with 14%. Also, 78% of users have chosen wMATIC for this purpose.

- Moonbeam has been the most popular destination among users of this platform in Polygon with more than 34% of the amount. Avalanche is in the next position from this point of view.

\

Observations

According to the obtained results:

- The total amount swapped from this network using the Squid platform was $58k, which was done by 11 people in 82 transactions. The average amount is 277 dollars.

- February 4 was the peak amount of transactions with 57k $ in total of 10 transactions.

- 90% of swaps belonged to wETH . USDT is next with 8.11%. Also, 74% of users have chosen wETH for this purpose.

- Avalanche has been the most popular destination among users of this platform in Arbitrum with more than 83% of the amount. Binance is in the next position from this point of view.

\

Observations

According to the obtained results:

- The total amount swapped from this network using the Squid platform was $425k, which was done by 135people in 385transactions. The average amount is 327$.

- February 6 was the peak amount of transactions with 68k$ in total of 75 transactions.

- Moonbeam has been the most popular destination among users of this platform in Binance with more than 30% of the amount. Polygon is in the next position from this point of view.

Observations

According to the obtained results:

- The total amount swapped from this network using the Squid platform was $754k, which was done by 136 people in 533 transactions. The average amount is 429 $.

- February 9 was the peak amount of transactions with 254k$ in total of 72 transactions.

- 90% of swaps belonged to wAVAX . USDT is next with 3%. Also, 78% of users have chosen wAVAX for this purpose.

- Moonbeam has been the most popular destination among users of this platform in Avalanche with more than 39% of the amount. Fantom is in the next position from this point of view.

Findings and Conclusion

-

This has been a new and innovative initiative by Axelar Network, which, as seen, has been well received by the users of the networks reviewed. This indicates that the market is hungry for innovative and useful platforms and it is possible to create and produce such tools by identifying the needs.

-

Among all paths checked, in the last ten days, Ethereum to Fantom ranks first with $431k or 28% of the total amount swapped. Also, Ethereum to Moonbeam with $177k or 11% of the total amount swapped, in It ranks next.

-

Among all paths reviewed, in the last ten days, Polygan to BSC ranks first with 15% of total swaps. Also, Polygan to Fantom ranks next with 12% of total swaps.

-

February 12 was the peak amount of transactions with 264k$ .

\

I want to thank JACKPINE because his dashboard ehelped me to better understand the project .