Introduction

Introduction to Terra

What is Terra?

Terraform Labs (TFL) was founded by Do Kwon and Daniel Shin in January 2018. This company is the one behind Terra which is a blockchain powered by Proof-of-Stake (PoS) concept. Blockchains normally seek to do better in two main areas: cheaper fees and faster transactions. This is evident from Polygon, an L2 solution to Ethereum and various other L1s.

What is Terra’s aim?

Terra has a different focus compared to most other blockchains. Their main goal is to make a better kind of money and to build practical products for the masses to utilise. Some initial projects include partnering with payments services firms and creating a high yielding savings account. On its home page, Terra markets itself as ‘programmable money for the internet’.

What is Terra’s plan?

One of the key pain-points in the cryptocurrency space has been the challenge of creating and maintaining a stablecoin to enable mass adoption of cryptocurrency — even today, the most popular centralized stablecoins such as Tether and Circle continue to be pegged to more conventional currencies such as the US dollar via cash and cash equivalents.

This involves the injection of fiat currency and fiat-backed assets to maintain the value and peg of stablecoins, which are collateralized via these assets.

In contrast, the Terra blockchain maintains a decentralized stablecoin (TerraUSD, or UST) which utilizes an algorithm and its associated reserve token, LUNA, to maintain the balancing act of a 1:1 peg of UST to the US dollar.

The decentralized stablecoin UST is the basis of the Terra payments ecosystem, which has the ambition of powering an end-to-end digital financial system with mass adoption.

What are stablecoins?

Stablecoins are a type of cryptocurrency that is designed to be stable in price. It achieves this by pegging its value to a commodity, currency, or having its supply regulated by an algorithm. They are essential because it allows a user to move from volatile cryptocurrencies to a stable digital asset without having to convert to fiat.

What is UST?

A decentralised, algorithmic stablecoin pegged to the USD. A common misconception is that it is backed by LUNA. However, it is not. It is the algorithm that maintains the peg of UST.

What is LUNA?

LUNA is the native token of the Terra ecosystem. It is used for staking (validating transactions which secures the ecosystem) and governance (voting on changes to be made within the ecosystem). LUNA is also the other half of the equation that helps UST maintain its peg.

Relationship between UST and LUNA

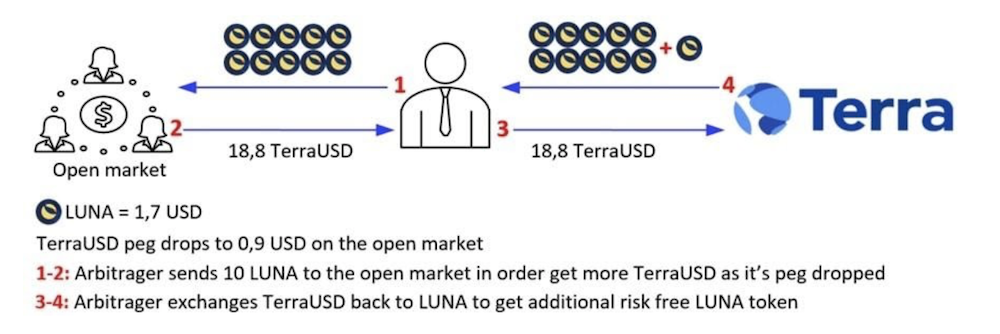

Based on Terra protocol’s market module, 1 UST can always be exchanged for 1 USD worth of LUNA. Even then, the price of UST may fluctuate due to macroeconomic factors such as demand and supply thereby deviating from its peg occasionally. However, a user will always be able to swap 1 UST for 1 USD worth of LUNA and vice versa. This gives rise to the practice of arbitraging when UST deviates from its peg and that is how the peg is maintained.

Assuming 1 UST rises in value to 1.1USD, an opportunity for arbitrage presents itself. Demand for UST will increase as people are incentivised to burn LUNA and mint more UST, capitalising on this 10% profit. Supply of UST increases allowing the price of UST to drop back to equilibrium. On the flip side of the equation, the supply of LUNA decreases which increases the price of LUNA, ceteris paribus. The opposite happens when UST is worth less than USD. Thus, the protocol ensures the supply and demand of Terra is always balanced, leading to a stable price.

Seigniorage is the value of a coin minus the cost of its production. In the Terra protocol, the cost of minting is very small. While seigniorage can create enormous value, it also creates inflation in the system. All seigniorage in the Terra protocol is burned, making Luna deflationary in nature.

Overview of the Terra Ecosystem

Just like the natural ecosystem we see in the world today, every aspect of nature has its part to play in maintaining a vibrant ecosystem. Similarly for Terra, every protocol has its own use and together, it helps the ecosystem to function better.

Given that LUNA underpins the entire Terra blockchain and payments ecosystem, the attractiveness of LUNA as an investment would be centrally dependent on the growth of Terra’s ecosystem in the future.

The following is a summary of the various protocols that serve to address the different needs and investment appetites of the institutional and retail markets.

The bottom line is that these protocols together increase demand for UST. Consequently, LUNA must be burned and this decreased supply means a higher LUNA price all else equal.[1]

image from [2]

Method

summary

-

I extracted Luna token price from the crosschain.core.fact_hourly_prices table

-

I used terra.core.fact_blocks and terra.core.fact_transactions tables for network performance, TPS : the total number of transactions of all blocks of the day divided by the number of seconds of the day

Average block Time: the average Time (seconds) between two blocks

-

I got all the information about the transactions from the terra.core.fact_transactions table

-

Luna transfers Volume calculated with help of terra.core.fact_token_transfers table

-

I extracted number of deployed contracts with help of

terra.core.fact_traces table

-

for swap stats I terra.core.ez_swaps

\

our approach for answering the project :

First, I have to say that beside January, I included December as the month before . The reason for this is to better understand the changes and to be able to compare the data obtained in the month of January to other months data so that we can better measure the impact of the market on it.

we will have 9 sections:

-

Luna prices: The token price of a network can represent all the activities that happened within the network, so we started this dashboard with the OP token price.

-

Network performance: In this section, we will review the overall performance of the network, including TPS and other important and influential parameters

-

Transcations stats: Here we analyze the number of transactions and active addresses and see if the network was active during this period or not.

-

Token transfers Volume: We take a look at the volume of Luna transfers within Terra

-

Contract deploying stats: To see how the activity within the network that aims to develop the ecosystem was in this month

-

NFTs: NFTs have become an inseparable part of the crypto world and should be included in any review of a chain.

-

Swap Stats: Swapping is the most popular activity within the network, so I think that's reason enough to check it out

\

All the Volume and price numbers are in USD

\

- $Luna Price

Observations

In January, we saw the price of Luna token rise from around 1.26 USD to 1.7 USD, which means more than 42% increase.

while in the months before and after , we saw price decreasing. This price increase could have helped to attract users to the chain, we will see whether it was so or not.

\

- Network performance

Observations

The average time to form a block (between two blocks) was at its lowest value at MAY 29 with 5.9 sec, but as we move towards the end of 2022, we see increasing to 7.2 seconds . Looking in general, we can conclude that a upward trend for this average was formed in 2022,and in 2023 till now.

In the month of May and June , we see the highest values in Terra TPS due to crash . but , by the time passes , the TPS is decreasing from 0.82 in highest to 0.08 in average on other days of 2022.we see an upward trend for TPs in 2023 to 0.3 on mid January.

Although we saw the highest daily percentage of failed transactions on May 28th to June 4th 2022 with over 20% in its higest, we cannot ignore the downturn trend of this percentage in 2022, in such a way that its percentage fluctuated from 1.5 to 9 on 2022.in 2023 we can see an upward trend for this metric .

- Transactions Stats

Observations

The charts show an increase in the total number of transactions and active addresses in Terra Blockchain since Christmas arrives and suddenly jump in that metric on Jan 9th .but the highest amounts were on May 29th with almost 70k and Sep 9 with 39k.since 2023 as mentioned, we can see an upward trend for this metric .

100% of users interacted with CEX on May 29th and after that, 78% on Juna 1st interacted with it. also, 22% interacted with dexs on June 1st. that was beacause users were escaping terra ecosystem.

There are two interesting points about the number of new addresses, the first is that we saw 5K active addresses on Sep 9th.

All this coincides with the increase in the price of Luna, which can be the reason for attracting users. And the second point is that we have the day with second most new addresses in Nov 14th and then after Christmas . the trend of daily new addresses was relatively positive on 2023.

Daily Fees and Fee per txn were also on their highest on May 29th.the interesting point is decreasing trend in this metric by the time going. we see a 87% drop in Fee per txn on early November from 0.08 to 0.01

- transfers Volume

Observations

As well as prior studied metrics, on June 2022 , the value of daily transfers increased significantly. we can see a positive change in the daily transfer value since Dec 25th, reaching 12M on Dec 27 from 1 M on Dec 25th.

the other bar charts also show the daily transactions per user and also the transactions per wallet and also the wallets per day. as the outcomes reveals, txns per day for December was 5k and it was 4.9k for January. wallets per day was 555on december and 665on January. But the txns per user was 9 on December and 7 on January.

The volume per sender was 30k$ on 2022 and 14k on 2023.The volume per txn was 2.2k$ on 2022 and 1.3k$ on 2023.

As the following charts reveals, the daily capital flow to/from Defi sector of Terra blockchain were most FROM Defi than to Defi !

as we can see, after Christmas, there were 2 days with highest amount transferred out from Defi platforms, Jan 9 with 58k and Dec 28 with 28 k.

- NFT stats

Observations

According to the obtained results, it can be said that the NFT market in Terra is not very prosperous. On October 17, with $30,000 sales, it has experienced its highest amount since 2022 until today. But gradually, the sales have decreased. But since the beginning of the new year, a positive trend has been observed.

We also see that all the following metrics have experienced a positive shock since Christmas Day and have started a positive upward trend:

- daily sales per collection

- daily sales volume $ per collection

- daily #sales per Buyer

- daily USD per per Buyer

- Swap stats

Observations

-

As a result of the collapse of this network and the sharp drop in the value of its token, and as a result, people fleeing from it, until the end of June 2022, 100% of the swaps related to Luna have been swap out. Over time, it can be seen that with a positive and stable trend, Swap in has gradually increased and reached more than 30% at the end of the chart, and this indicates the gradual return of users' trust in this network and its token.

-

The highest value of Swaps in for Luna Token was on Dec 4th with over $100M against 23k swap out . Also, on the 6th of December and the 16th of August, with almost 4M$, the most swaps from Luna token to other tokens happened.

-

LunaX,TPT and Astro have been the top threetokens in the swap from Luna Token.

-

In terms of average swap size, 2023 is higher than 2022 in terms of Luna in with 700k against 523k.in terms of Luna out, 2022 ranks first with 6k against 700 for 2023. this is also a good sign.

\

- Staking Stats

Conclusion

- We saw the price of Luna token rise from around 1.26 USD to 2.09 USD, which means more than 60% increase since New year arrived.

- by the time passes , the TPS is decreasing from 0.82 in highest to 0.08 in average on other days of 2022.we see an upward trend for TPs in 2023 to 0.3 on mid January

- Although we saw the highest daily percentage of failed transactions on May 28th to June 4th 2022 with over 20% in its higest, we cannot ignore the downturn trend of this percentage in 2022, in such a way that its percentage fluctuated from 1.5 to 9 on 2022.in 2023 we can see an upward trend for this metric .

- 100% of users interacted with CEX on May 29th and after that, 78% on Juna 1st interacted with it. also, 22% interacted with dexs on June 1st. that was because users were escaping terra ecosystem.by the tie passsing, interacting with CEX became less popular and reached 0 % in most of th days as a sign of retrieving user trust.

- As a result of the collapse of this network and the sharp drop in the value of its token, and as a result, people fleeing from it, until the end of June 2022, 100% of the swaps related to Luna have been swap out. Over time, it can be seen that with a positive and stable trend, Swap in has gradually increased and reached more than 30% at the end of the chart, and this indicates the gradual return of users' trust in this network and its token.

- With all cases reviewed in Terra blockchain , it can be concluded that, we can say , y the time giing , more and more trust is getting back to Terra ecosystem and users start to interact with its different sectors gradually. we should wait and see if this positive trend continues or not.

- LP stats

- As it is clear from the results, from the end of May 2022 to the end of November, staking has gone down and most of the time, the volume of unstaking has been higher. But from the end of November onwards, with the relative return of trust and peace to the network, users have started staking, and the volume of staking in late December 2022 is almost equal to unstaking.

- like other subjects studied in which Christmas had a significant and insignificant effect on the process of the informed case, this is also the case for staking. So, as it is clear from the charts, staking have gone upward and shows a positive change after christmas arrived.

Why did Terra Crypto Crash?

A variety of different cryptocurrencies make up the algorithmic stablecoin UST. Under normal market conditions, the arbitrage activity that keeps UST pegged is successful. However, one-sided buys or sells can’t maintain equilibrium during strong crypto market bear markets. This typically breaks the peg, and this is exactly what happened with UST. Depending on which side was violated, this necessitates strong involvement, such as excessive purchasing or selling.

The above was coupled with mismanagement from the founder of Terra. This caused chaos in the crypto market, especially since the crypto market was already crashing. link