An On-Chain Analysis of $AUDIO usage and AUDIUS Service Providers

SoundCloud on the blockchain? Let’s Go @AUDIUS

What is Audius?

Audius is an artist-controlled and community-owned music streaming platform, aiming to enable any user to freely distribute, monetize and stream audio.It was co-founded by Roneil Rumburg and Forrest Browning, both computer scientists with Ivy League degrees. The pair also were early Bitcoin adopters and investors in Lightning Labs. (source)

How Audius Network Works ?

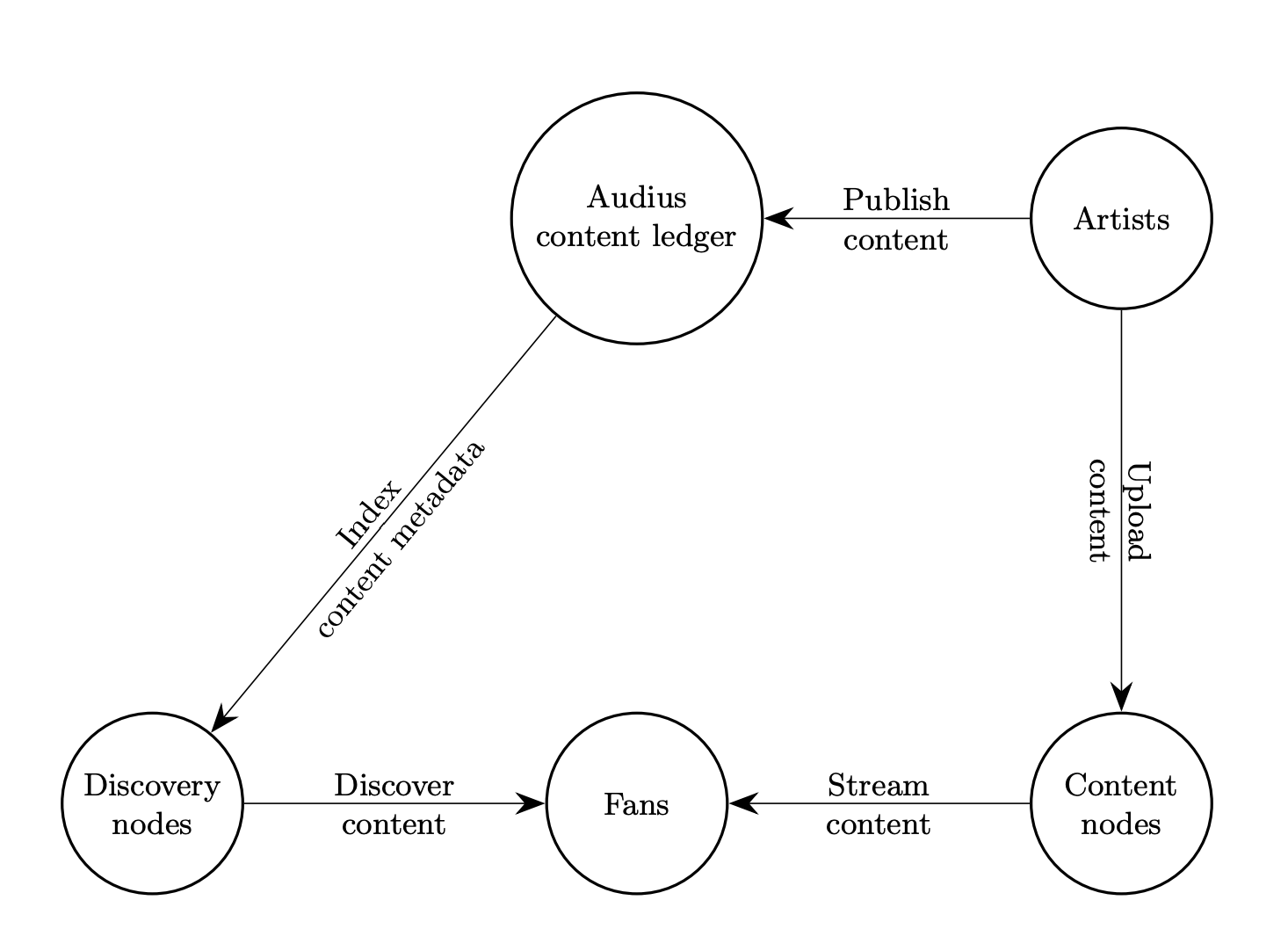

The Audius blockchain is secured by two types of decentralized nodes that support the network:

-

content nodes that host contents and

-

discovery nodes that index content.

Source: Audius Docs

By becoming content nodes, artists can host their own music without having to rely on other nodes. For artists who simply wish to upload music, content nodes are randomly selected to host their songs. If a particular content node goes offline, the blockchain automatically replaces it with a new one, without involving the artist. Audius claims that its content will be just as secure and decentralized.

Audius nodes continuously send snapshots of the protocol's InterPlanetary File System (IPFS) to the Ethereum network. The IPFS is where artists store their music on the network. (source)

AUDIO is the community token of the Audius network. A multi-chain token, most of its functions are performed on the Ethereum platform, with some side features on Solana(source).

Migrating parts of the Audius into the SOLANA

At Audius, we strive to integrate payments and user-to-user transfers seamlessly into the platform. The engineering team spent considerable time exploring how to scale payments beyond Ethereum onto a faster and cheaper L1, ultimately arriving at Solana as our L1 of choice. Moving to Solana would require bridging the existing Ethereum based ERC-20 Audio token to a new chain via the Portal Token Bridge, and then once the tokens were on Solana, the interesting part: adapting our existing wallet system to work with the new Solana based $AUDIO.(source)

In an announcement shared with CoinDesk in advance, the Audius team wrote(source):

> "Given our need to utilize a high-performance blockchain today, Solana's growing set of 182 validators (as of this writing) combined with a battle-tested architecture gives our community the confidence that Audius's catalog can scale at ease, a crucial component of our path to mainstream adoption."

What is this dashboard all about?

Since the main information of the AUDIUS platform is stored on the content and discovery nodes and off-chain, it is not possible to completely study this network through blockchain data.

However, given that the main token of this network, AUDIO, is minted on the Ethereum network and the payment of rewards for operating nodes and staking users occurs on this network, in this dashboard, focusing on the Ethereum blockchain, we will look at the amount of AUDIO trades and the transfer volume of this tokens over time.

Then we will check how the staking behavior of users is and whether there has been a change in the volume and number of $AUDIO staking or trades in the last few months or not?

Image Credit : TechCrunch

Dashboard Structure

- Work Description

- An Overview of $AUDIO Price

- Trade activities

- Tracking $AUDIO transfers

- Service Registration

- Staking $AUDIO

Work Description

All analyses in this dashboard were performed based on the core Ethereum tables of the FlipsideCrypto datasets and using the official documentation from AUDIUS and, of course, numerous references to Etherscan.

The two main contracts used in this analysis are:

-

AUDIO Token:

0x18aaa7115705e8be94bffebde57af9bfc265b998 -

Governance-Contract:

0x4d7968ebfd390d5e7926cb3587c39eff2f9fb225The details of each section are explained in the respective sections.

\

References

#1 - Trade Activities

In the second step of the analysis, we will examine UniSwap's liquidity supply pools corresponding to the AUDIO token to find out which tokens users swapped AUDIO into over time or from which tokens and with what volume they purchased AUDIO.

Of course, as can be seen in the charts, almost 100% of the swaps were in the AUDIO-WETH liquidity pool and between AUDIO and WETH tokens.

About Me

Mojtaba Banaie

Email : mojtaba.banaie@gmail.com

Twitter: @cryptolizr

Discord : smbanaie#5528

Date of Analysis : 2022-12-23

Takeaways

According to the on-chain data, it seems that AUDIO protocol is expanding its operating nodes, and apart from the fact that the amount of unstaked $AUDIO by users in 2022 exceeds the amount of staking, there is no other negative point in the behavior of users towards this platform.

The price of this token has moved fully in line with Ethereum and we hope that the price of this token will resume its growth with the growth of the cryptocurrency market.

Observations #1

- As can be seen in the charts, almost 100% of the swaps have been in the AUDIO-WETH liquidity pool and between the AUDIO and WETH tokens.

- There is not much difference between the mean and average volume of monthly swaps, and this average has reached about $8000 at the beginning of the year to about $800 at the end of 2022.

- We see the largest trading volume in April , although in terms of volume, the largest number of AUDIO tokens was exchanged in July.

- The number of trading users in the different months of the year did not change much and remained constant at around 600 people (with a little up and down).

Board Parameters

-

Start Date

If needed, you can enter the

start_dateof the analysis in the beginning of the dashboard and then click on the option Apply All Parameters to update all charts.

Note: The end time of the analysis corresponds to the current day.

Correlation Coefficient

A correlation of -1.0 indicates a perfect negative correlation, and a correlation of 1.0 indicates a perfect positive correlation. If the correlation coefficient is greater than zero, it is a positive relationship. Conversely, if the value is less than zero, it is a negative relationship. (source)

R-squared is a goodness-of-fit measure for linear regression models. This statistic indicates the percentage of the variance in the dependent variable that the independent variables explain collectively(source)

Image Credit : Slideshare

$AUDIO Transfers

In the first part, we analyzed AUDIO traders based on swaps made in Uniswap. In this section, we want to monitor the inflows and outflows of money by AUDIO users based on the address labels of centralized exchanges such as Binance.

We assume that users who transfer their tokens to the CEX exchanges want to sell them(sellers), and that those who transfer their tokens from the CEX exchanges to their personal wallets have bought them(Buyers). Under this assumption, the following diagrams were drawn, which we will analyze together

Image Credit : The News Crypto

Service Registration

In the third step, we analyze the number of services registered by operators. Each operator can launch a content or discovery service if it stake more than 200,000 AUDIO tokens.

In this part, we will analyze the staking amount of the different operators and the number of their different services over time.

Note:

- In the Ethereum event table, the event type

RegisteredServiceProviderwas used to get the following information.

Staking Activity

In the last part of this analysis, we will examine the amount of $AUDIO staked by normal users in this network, and we will check out the behavior of users in choosing operators for staking and the amount of $AUDIO unstaked in the specified period (default: 2022) and which operator had the largest capital loss and which had the largest capital gain by staker users.

Observations

- The amount of unstaked $AUDI token is about 100 million tokens higher than the amount of stakes in this period.

- But the number of investors is higher than the unstakers, although their average stake volume is much lower than the withdrawal amount. It is possible that fear of a sharp drop in prices has led to an increase in withdrawals. The largest volume of Unstaking has occurred since August, coinciding with the market decline.

- Staked (100 million) and Figment (30 million) have seen the largest drop in their delegated AUDIO amount, but BdNodes has managed to attract about 40 million tokens from users.

Observations #2

- On the buy side of the AUDIO token, the three exchanges Coinbase, Binance, and Paribu each accounted for about a quarter of the buy volume, but on the sell side, over sixty percent was done on Binance and about ten percent on Kukoin. It appears that after purchasing the AUDIO token, users kept the tokens in their exchange account (resulting in much more money being spent on Binance than was received there).

- The total number of AUDIO buyers is more than twice the number of sellers. For this reason, the average number of tokens sold is much higher than the average number of tokens purchased by users.

- AUDIO purchase volume jumped in November, although the behavior of sellers and buyers did not change significantly in the other months of 2022.

- The average and median purchases are very different, and the average is much higher than the median, meaning that few users made large purchases. We can see this imbalance on the sales side.

An Overview of $AUDIO Price

Let's first take a look at the price of AUDIO and its relationship to the price of ETH and see if we can find a relationship between the two.

Observations #0

As the graphs show, the price of AUDIO and ETH are fully interconnected, i.e. the price of AUDIO is fully influenced by ETH, and as the R2 coefficient shows, about 92% of AUDIO's price changes are due to changes in the Ethereum price.

Observations #3

- Most of the services in the AUDIUS network have been established by a small number of operators, namely :

- Culture3Stake

- Figment

- BdNode

- Audius

- Staked

- The largest volume of investment (staking) in AUDIUS is done by Figment and Staked, which account for more than 90% of AUDIO's staked volume by node operators.

- The number of content and discovery services is about the same, but the amount of capital staked by new content services in 2022 is about twice the amount of capital staked for discovery service launches.